And the Instructions for Schedule F (Form 1040) for information about where to Box 8 If this box is checked, the amount in box 2 is attributable to an income tax that applies exclusively to income from a trade or business and is not a tax of general application If taxable, report the amount in box 2 on Schedule C or F (Form 1040), as appropriate18 Schedule C Tax Form Fill out, securely sign, print or email your instructions form 1099 c 10 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!Form 1099 Nec 19 Video Bokep Indo Terupdate Lihat Dan Unduh Video Bokep Indo form 1099 nec 19 Form 1099 Nec Schedule C Form 1099 Nec Schedule C Video Bokep Indo Terupdate Nonton Dan Download Video Bokep Indo form 1099 nec schedule c Video Bokep ini adalah Video Bokep yang terkini di October 21 secara online Film Bokep Igo

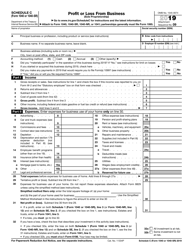

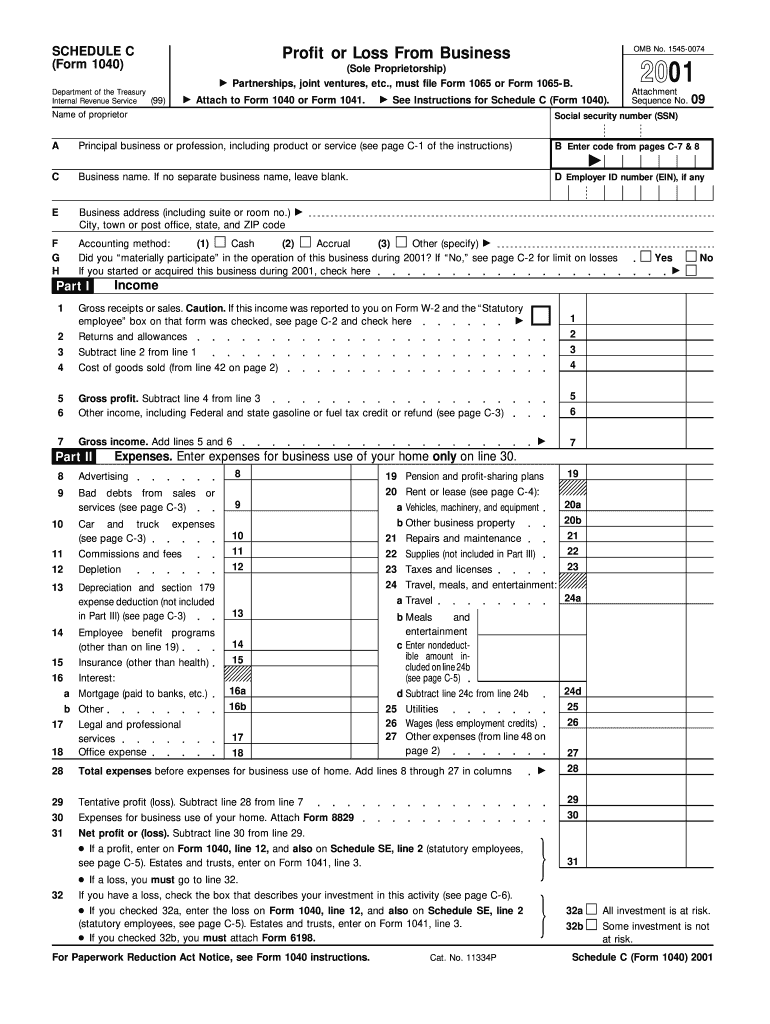

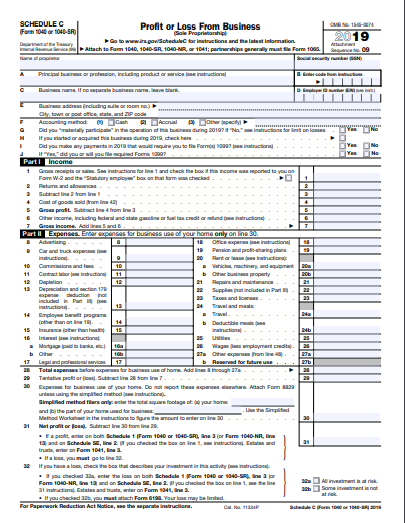

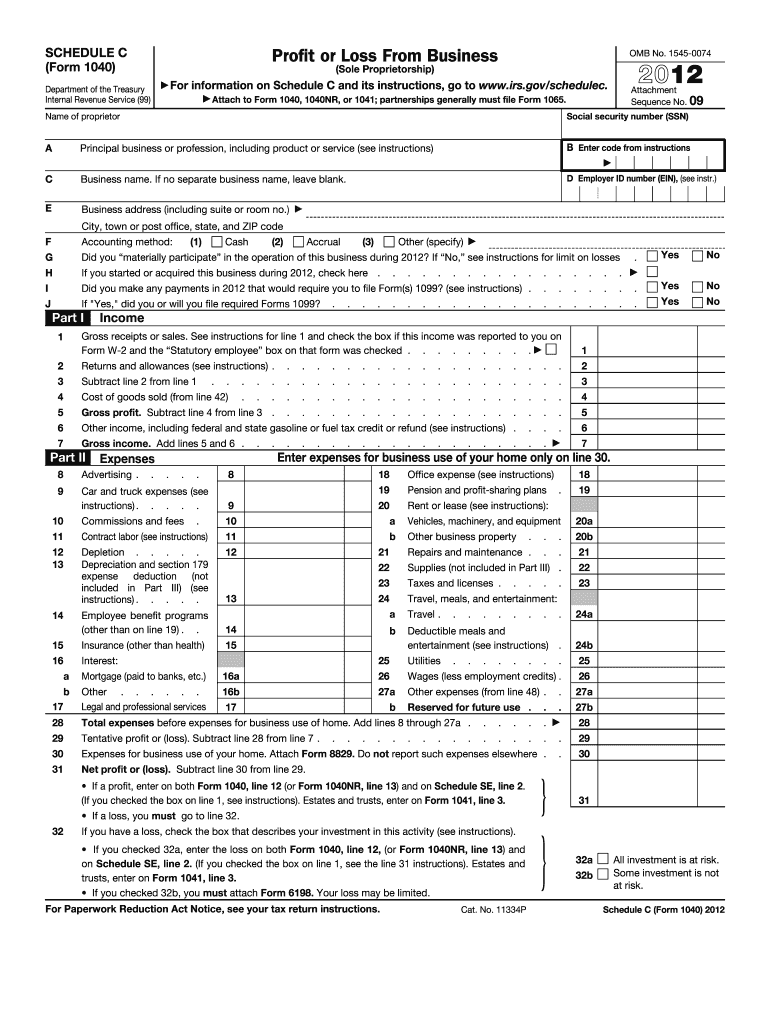

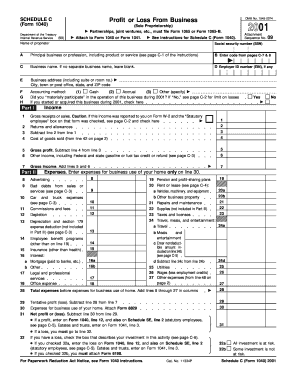

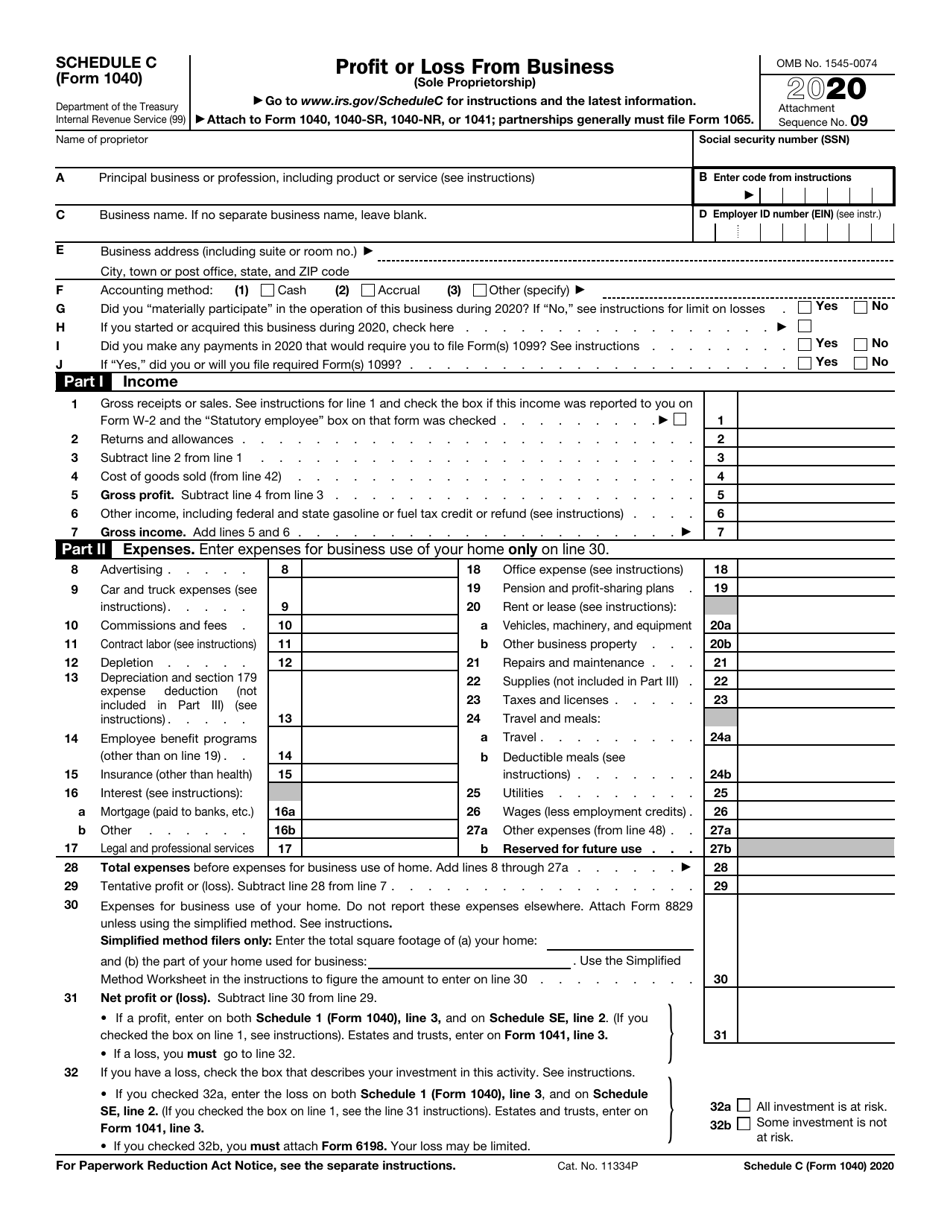

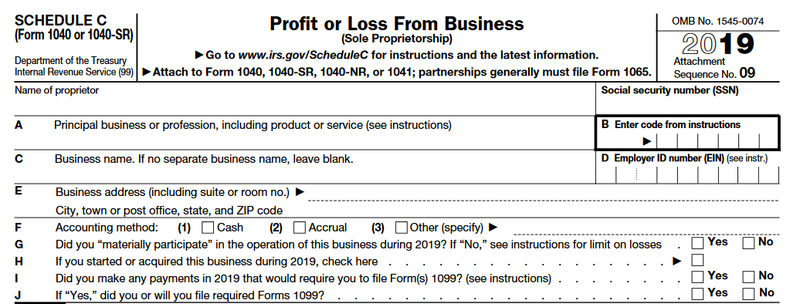

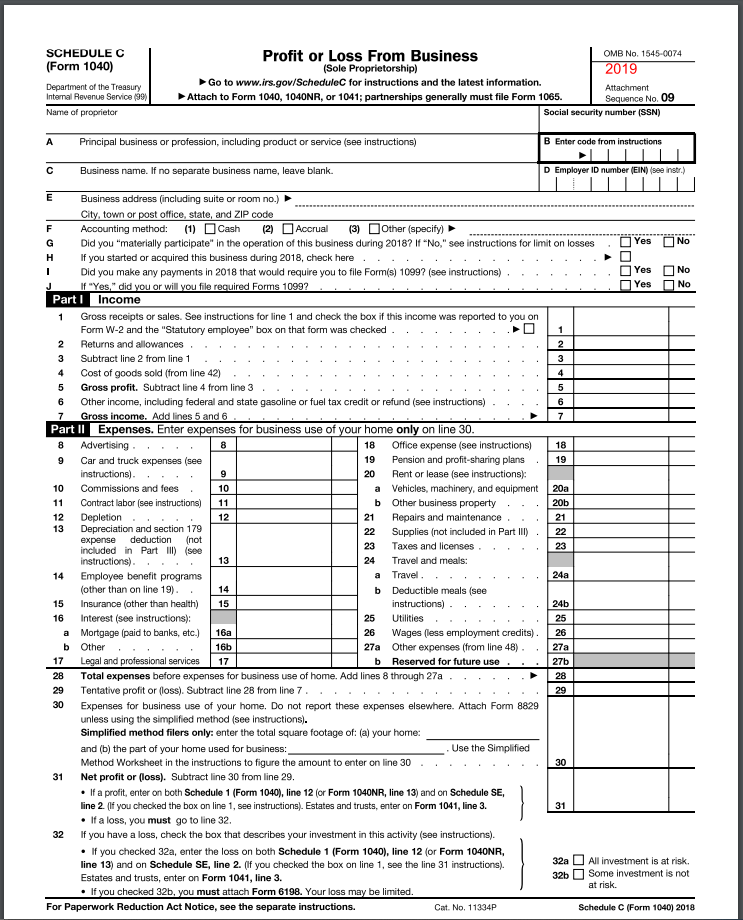

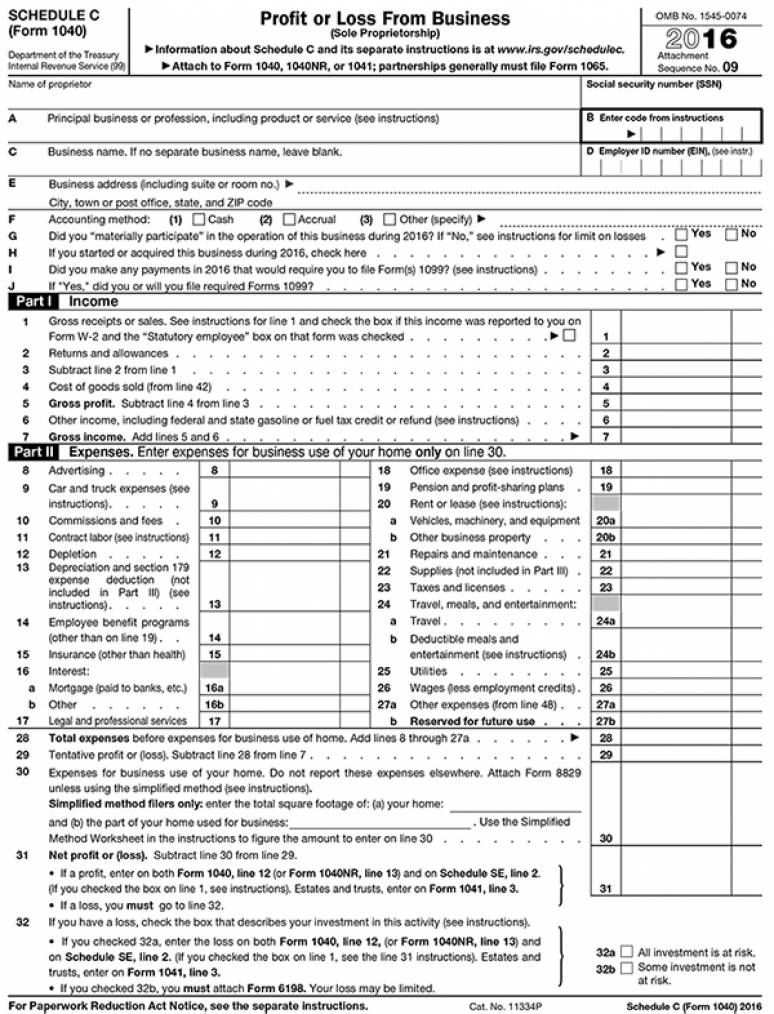

Irs Form 1040 1040 Sr Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship 19 Templateroller

1099 schedule c form 2019

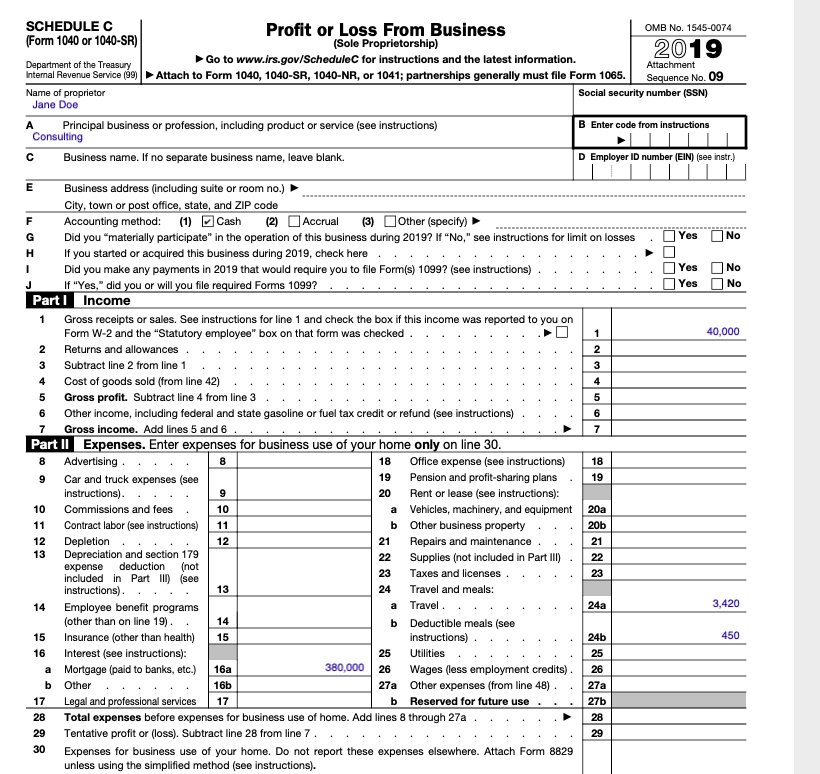

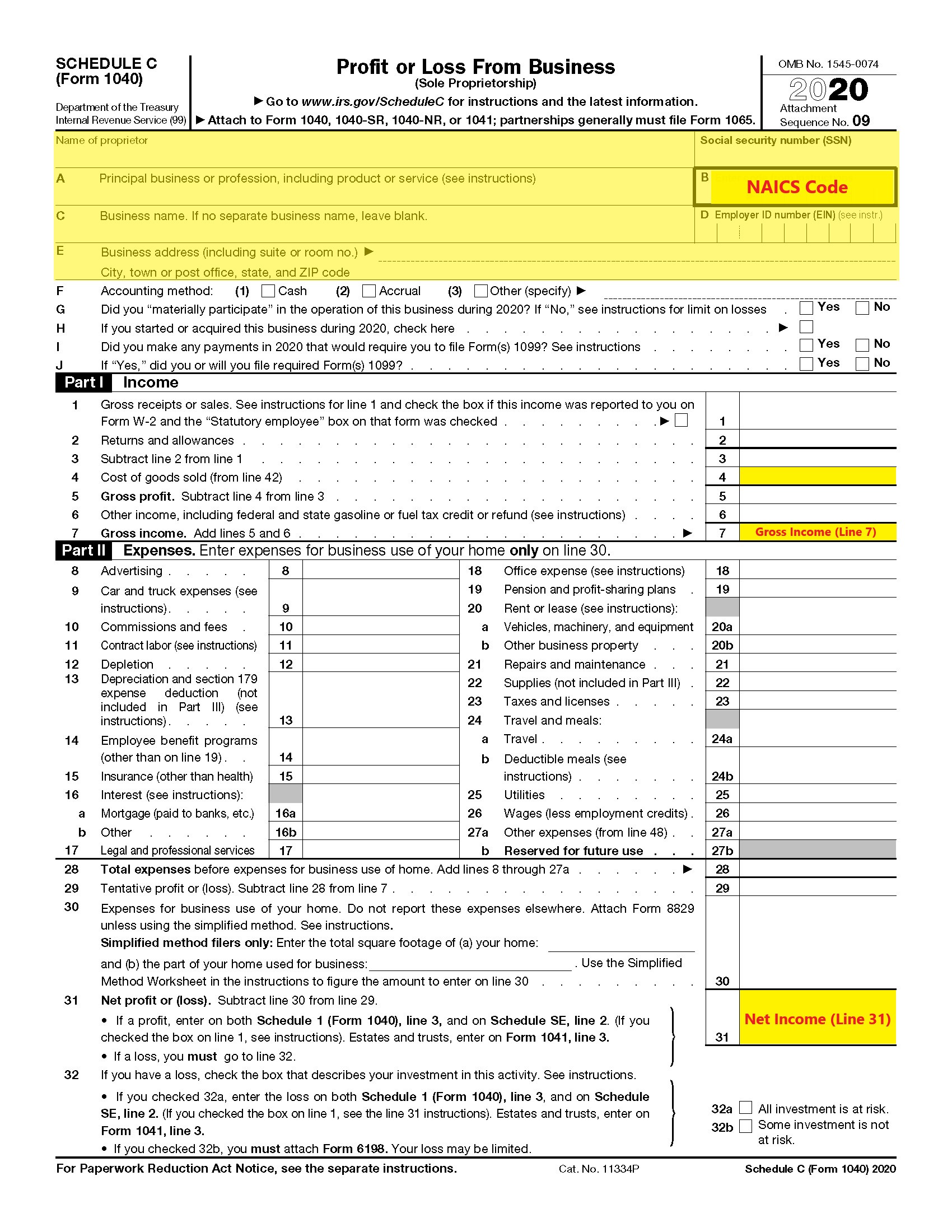

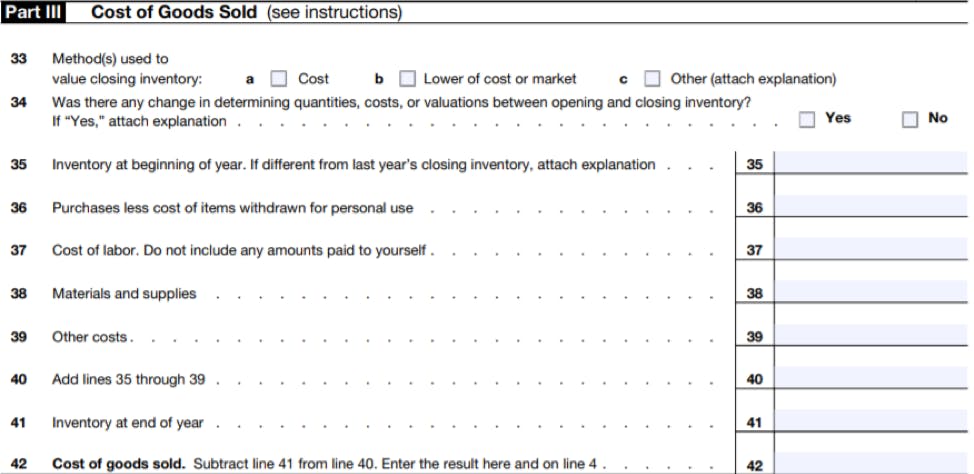

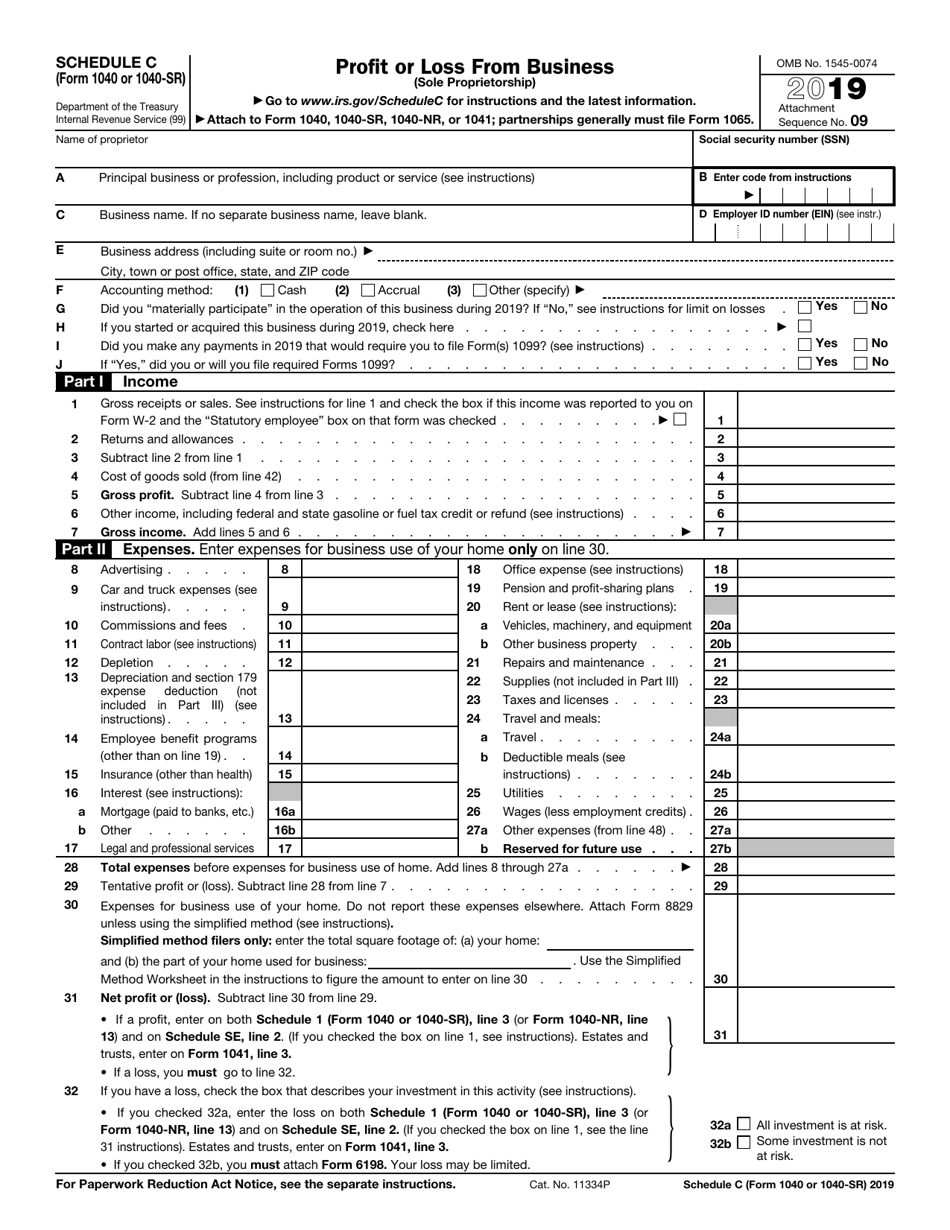

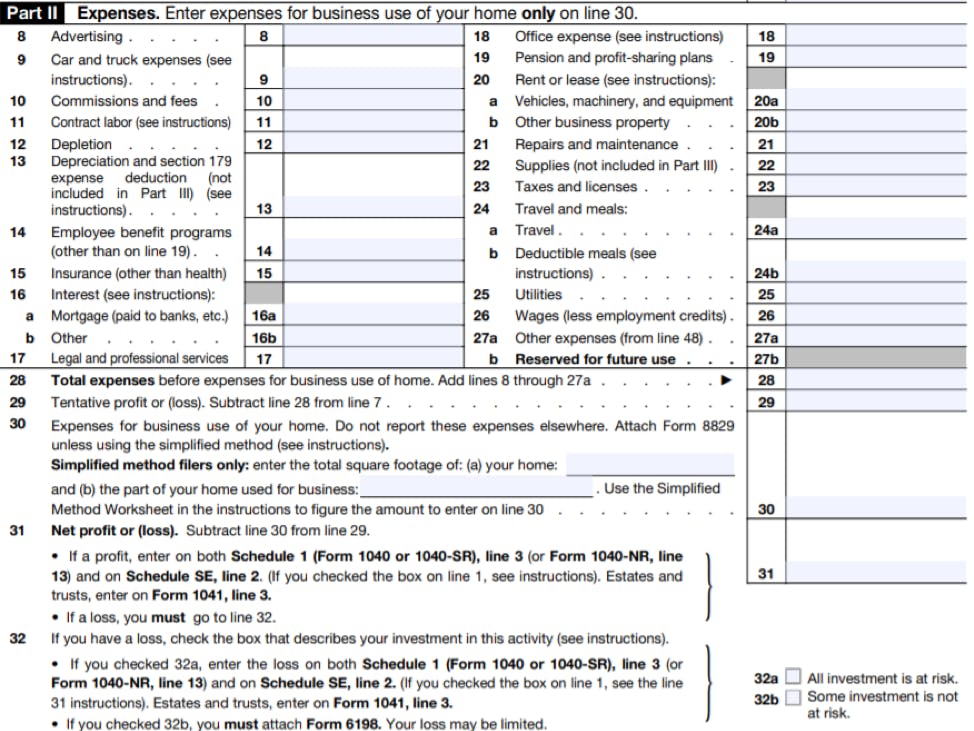

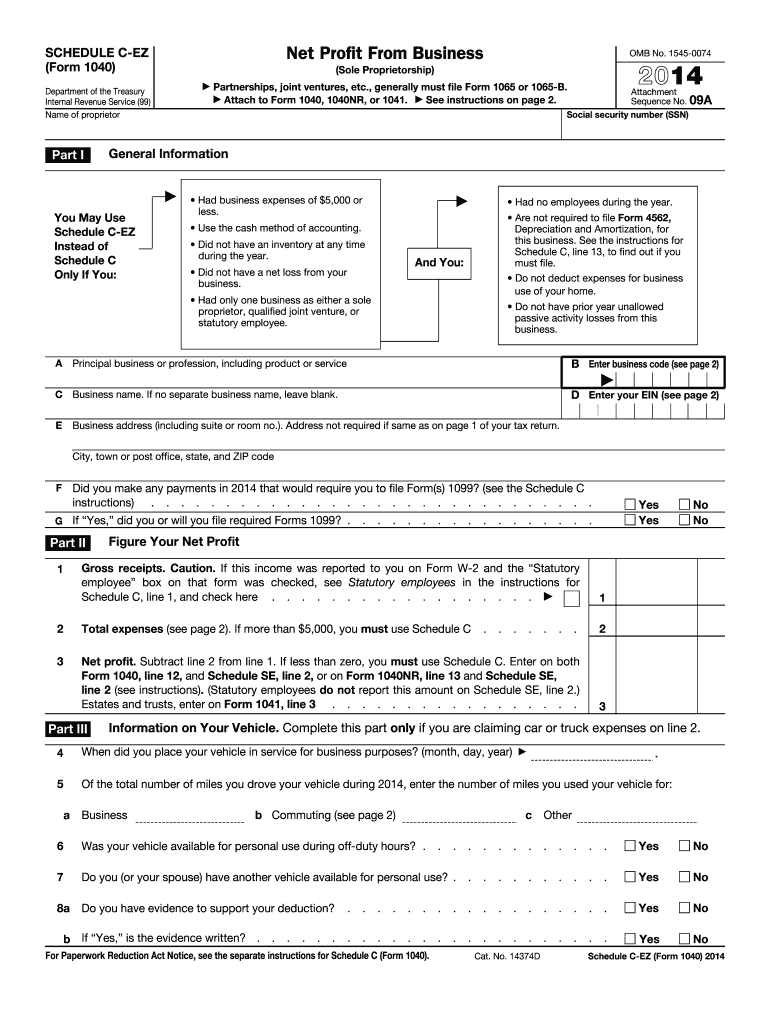

1099 schedule c form 2019- Using Schedule CEZ instead (for tax years prior to 19) Many sole proprietors are able to use a simpler version called Schedule CEZ This form omits a lot of the detail in the full Schedule C and just asks for your total business receipts and expenses However, you still need to complete a separate section if you claim expenses for a vehicleA Schedule C is a supplemental form that will be used with a Form 1040 This form is known as a Profit or Loss from Business form It is used by the United States Internal Revenue Service for tax filing and reporting purposes This form must be completed by a sole proprietor who operated a business during the tax year

Irs Schedule C 1040 Form Pdffiller

The Form 1099K, Payment Card and Third Party Network Tran sactions, is a tax form that shows all the paymentsThe IRS considers any income reported in Box 1 of the 1099NEC as selfemployment income and looks for it to be reported on either Schedule C or F If you received a Form 1099NEC with nonemployee compensation but you should've received the income on a W2, you don't need a Schedule C for your 1099NEC We'll ask you questions to determine the The information in this article is up to date through tax year 19 (taxes filed in ) If you are selfemployed and you accept payments using PayPal or something similar, you could receive a 1099K when it is time to file your taxes What is Form 1099K?

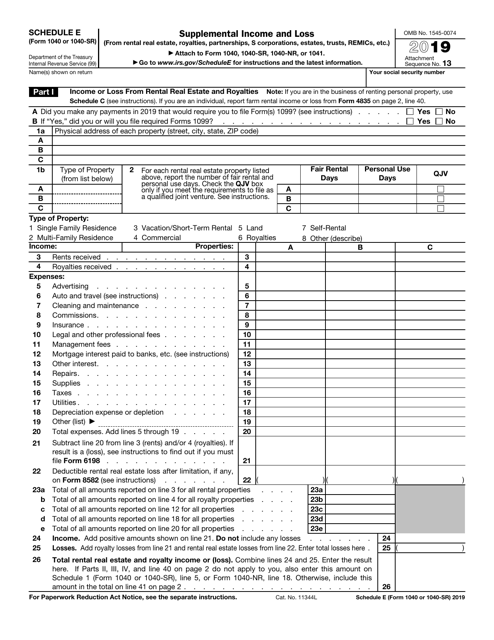

Entries on Form 1099G, Box 6 Taxable Grants (this covers certain government payments) are generally reported on IRS Schedule 1 (Form 1040), Line 8 If the item relates to an activity for which you are required to file Schedule C, E, or F or Form 45, report the taxable amount allocable to the activity on that schedule or form instead IRS Discontinues Schedule CEZ and Other Forms for 19 IRS has announced that, for 19, it will not be issuing certain forms that it issued in 18 The obsolete forms are IRS has also announced that Form 1099H, Health Coverage Tax Credit (HCTC) Advance Payments, will be obsolete after the 19 tax yearForm 1099C Cancellation of Debt Form 1099DIV Dividends and Distributions Based on aggregated sales data for all tax year 19 TurboTax products Most Popular Feature available within Schedule C tax form for TurboTax filers with 1099NEC income

If you are filing a 1099NEC with income in Box 1, you will be prompted to add the income to an existing Schedule C or create a new Schedule C after completing the 1099NEC entry If you receive a 1099K, the IRS requires this income to be reported as income on the Schedule C For more information about the 1099K, please click here If you're selfemployed or an independent contractor, you'll report your 1099K income on Schedule C of form 1040 To report your 1099K income on this form, simply enter your gross 1099K income on line 1 of Schedule C If you received more than one 1099 form, you need to add them together and report the total amount of money you madeInst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Inst 1099B Instructions for Form 1099B, Proceeds from Broker and

Irs Schedule C 1040 Form Pdffiller

1099 C Fill Out And Sign Printable Pdf Template Signnow

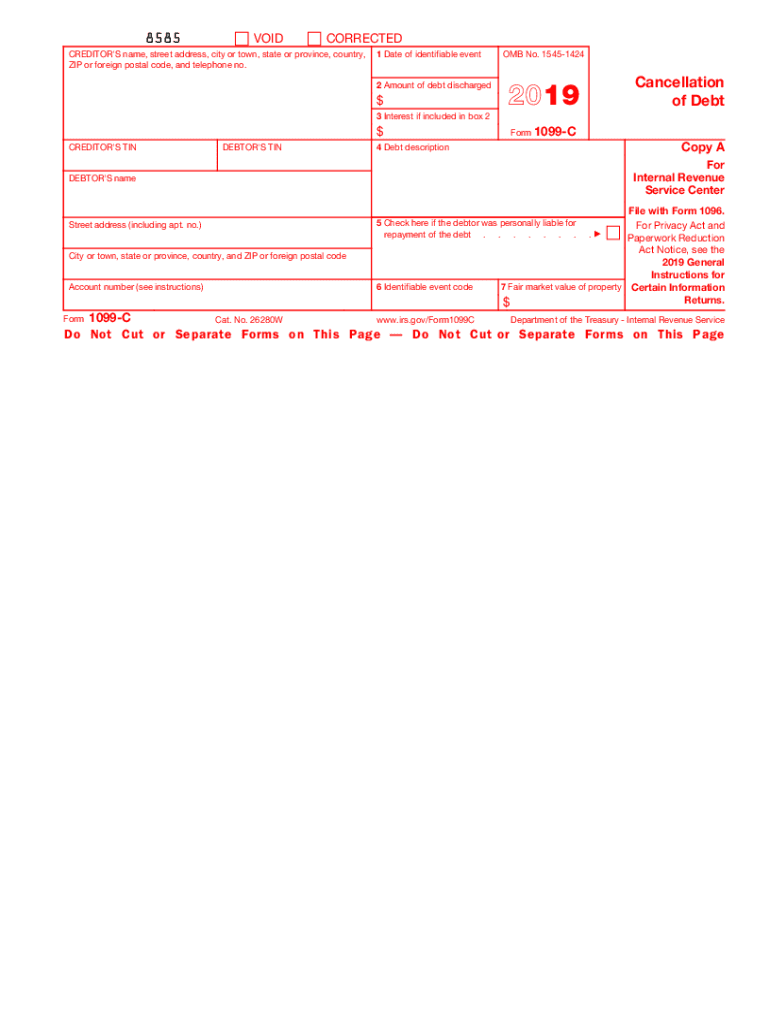

Use the navigation steps above to enter your capital gain or loss transactions on Form 1099B Use the steps below to enter your expenses on Schedule C Click Federal On smaller devices, click in the upper lefthand corner, then select Federal1099MISC for 19, 18, 17 Download 1099MISC for Additionally, use a a Form 1099MISC for It is designated as Rents You would report rents from real estate listed on Schedule E or Schedule C (depending on your circumstances) You can learn more about this box in the IRS instructions for the 1099MISC FormA form 1099C falls under the 1099 tax form series of information returns These forms let the IRS know when you have received income outside of your W2 income Any company that pays an individual $600 or more in a year is required to send the recipient a 1099 You are likely to receive a 1099C when $600 or more of your debt is discharged

Uber Tax Filing Information Alvia

Re 1099 Misc Income Doesn T Appear On Schedule C

IRS Form 1040 Schedule C (19) IRS Form 1040 Schedule C () IRS Form 1040 Schedule CEZ (18) IRS Form 1040 Schedule D (18) IRS Form 1099MISC is required to report payments made to non employees to both the IRS and the person or individual who received the payment The form_type parameter A_1099_MISC for the Upload PDF endpoint isOn the screen titled What schedule or form should the income on this Form 1099MISC be reported on?, assign the Form 1099MISC to the applicable Schedule C or Schedule E (if you have not yet completed Schedule C and/or E, you will need to do this first in order to assign the Form 1099MISC) from the Assigned schedule or form drop down menuWhen you enter the form, box 6 does default to line 21, so to transfer the amount to Schedule C you must use a workaround In the TurboTax SE version, business income comes first, so enter the taxable grant as general income on the Schedule C

Fill Free Fillable Irs Pdf Forms

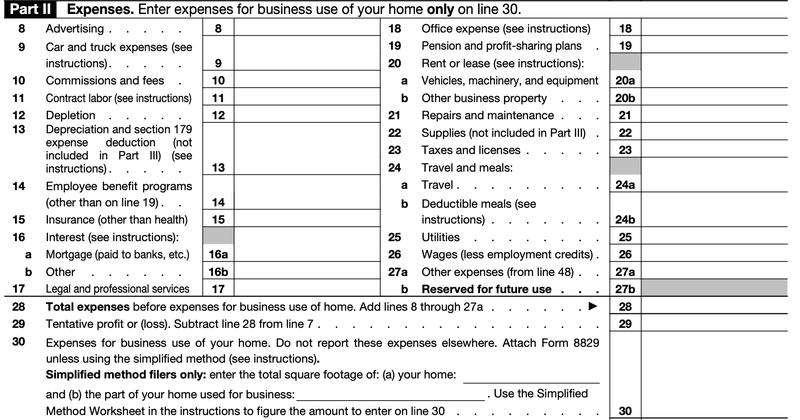

How To Fill Out 19 Schedule C Form 1040 Part Ii Expenses Line 8 To Line 17 Youtube

Instructions for Form 1099B, Proceeds from Broker and Barter Exchange Transactions 21 Form 1099C Cancellation of Debt (Info Copy Only) 21 Form 1099C Cancellation of Debt (Info Copy Only) 19 Form 1099CAPIf the payment is in Box 3, Other Income, click the "Link" check box to link the 1099MISC to Schedule C or F and you will be prompted which schedule to link to after exiting the 1099MISC entry screen Otherwise, leave the "Link" check box unchecked and the amount will flow to Other Income on Schedule 1 (Form 1040 or 1040NR)Separate reporting of Form 1099K is no longer required by the IRS Within Drake Tax, gross receipts received via payment card (credit and debit cards) and third party network payments can be entered on the following screens as an undifferentiated part of gross receipts Screen C Schedule C Screen E Schedule E Screen F Schedule F

1

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

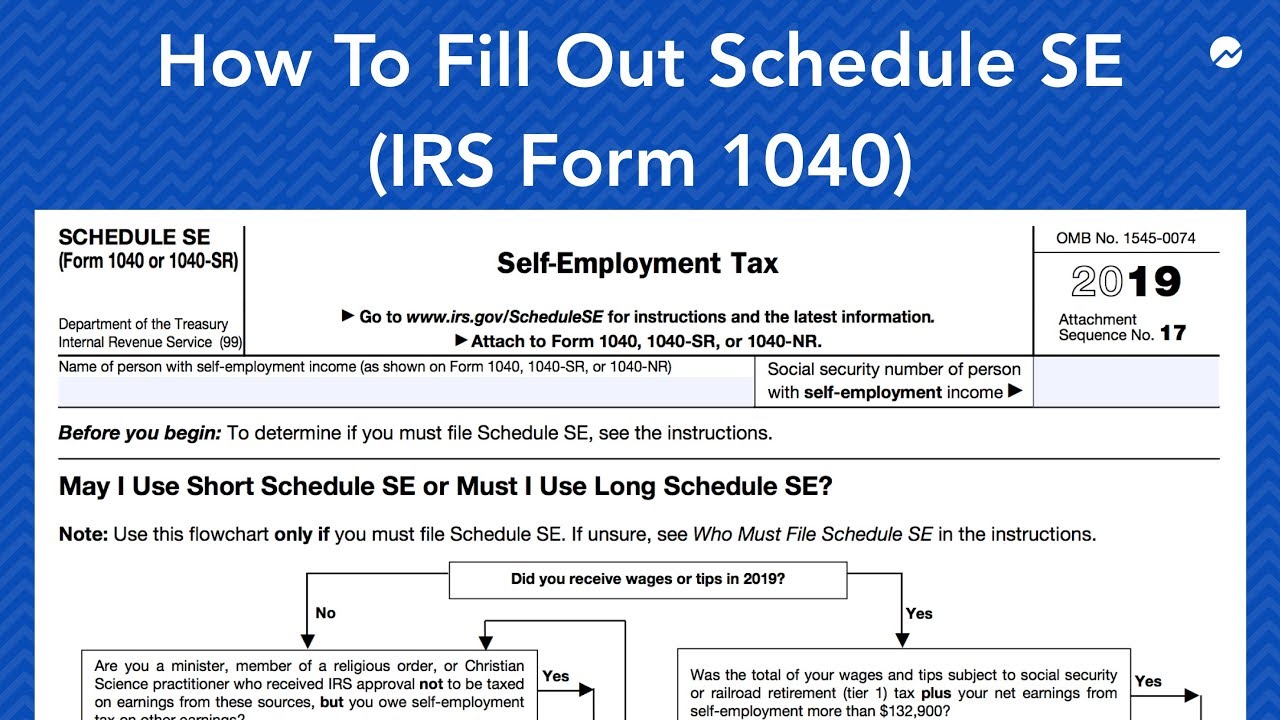

Click Create a New Schedule C to carry the income from Form 1099Misc If you already have a Schedule C, click the three dots to the right of the Schedule C to carry the income to the existing Schedule C The program will calculate the applicable selfemployment tax you will be subject to, based on the information provided in your Schedule CFor individuals, report on Schedule C (Form 1040) Box 7 Shows nonemployee compensation If you are in the trade or business of catching fish, box 7 may show cash you received for the sale of fish If the amount in this box is SE income, report it on Schedule C or F (Form 1040), and complete Schedule SE (Form 1040)If you had not yet completed Schedule C (Form 1040) Profit or Loss From Business or Schedule E (Form 1040) Supplemental Income and Loss, you will need to do so before you can assign the applicable Form 1099MISC Miscellaneous Information To enter or review the information from Form 1099MISC From within your TaxAct return (Online or Desktop), click Federal

I Got This After I Sent In Schedule C And 19 And 1099 Forms Why Are These People Playing With Me It S Annoying Af Trust Menill Be Calling And Email

About Schedule C Form 1040 Profit Or Loss From Business Sole Proprietorship Internal Revenue Service

Independent contractors use the Schedule C form to report business income If you're a 1099 contractor or sole proprietor, you must file a Schedule C with your taxes Your Schedule C form accompanies your 1040 and reports business income, expenses, and profits or losses If you operate a business in the Sharing Economy or if you work as anThe 1099MISC form is a form that reports an individual's extra earnings, aside from the salary paid by their employer The employer must generate a 1099MISC form and send it to his employee by January 31st, so that the employee can use it when filling his yearly taxes to the IRS (Internal Revenue Service)C Form 1099 Fill out, securely sign, print or email your 1099c 10 form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

4 Tax Programs To File Self Employed Taxes Online For Less Than 100 Careful Cents

1099 Misc income doesn't appear on Schedule C Under the Personal Income tab scroll down to "Business Items" and start there Also, on the 19 IRS Form 1099MISC box 7 is not longer valid It's greyed out on the form The income "MUST" be reported in box 3 Schedules C and CEZ are used to report the income and expenses that relate solely to your selfemployment activities However, you must also report the net profit or loss in the income section of your 1040 form But before evaluating whether you are eligible to use the shorter Schedule CEZ, you need to insure that you are in fact selfemployed As such, the income for soleproprietors is reported on their Schedule C as gross receipts subject to the selfemployment tax Partnerships and corporations would report those amounts in a similar manner on their returns IRS enforcement of the 1099K form reporting When it first debuted in 11, Form 1099K was treated as almost a second thought

Instructions For Form 95 A Internal Revenue Service

18 21 Form Irs 1040 Schedule C Ez Fill Online Printable Fillable Blank Pdffiller

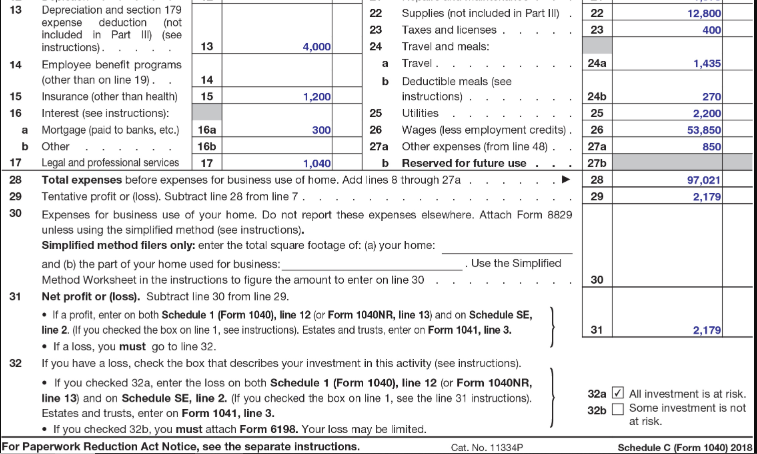

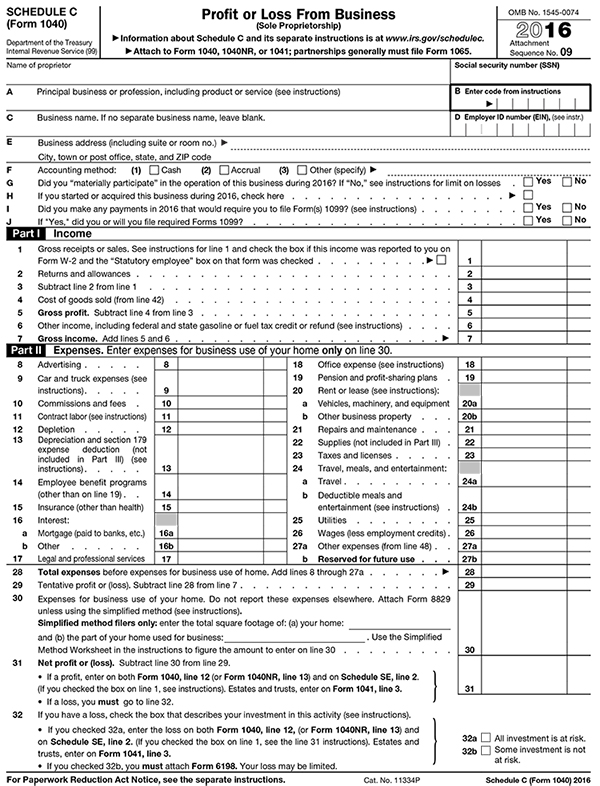

ProWeb Form 1099Misc and Schedule C Form 1099Misc is used to report any miscellaneous income to a taxpayer that would not be included on a Form W2 This income can be for services, rents, royalties, prizes, etc Generally, any amounts in box 3 of the Form 1099Misc can be reported as Other Income on Form 1040, Line 21Form 1041, line 3 • If you checked 32b, you must attach Form 6198 Your loss may be limited } 32a All investment is at risk 32b Some investment is not at risk For Paperwork Reduction Act Notice, see the separate instructions Cat No P Schedule C (Form 1040 or 1040SR) 19Get And Sign Instructions For Schedule C Internal Revenue Service 21 Form This line Line H If you started or acquired this business in check the box on line H Also check the box if you are reopening or restarting this business after temporarily closing it and you did not file a 19 Schedule C for this business

Ppp Faqs 1040 Schedule C Tips For Independent Contractors Sole Proprietors And Self Employed

Step By Step Instructions To Fill Out Schedule C For

Schedule C Fillable Form 19 Fill out, securely sign, print or email your 19 Instructions for Forms 1099A and 1099C IRSgov instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!Form 1099C 19 Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you ifThe IRS Schedule C form is the most common business income tax form for small business owners The form is used as part of your personal tax return For 19 and beyond, you may file your income taxes on Form 1040 The 1040SR is available for seniors (over 65) with large print and a standard deduction chart

Sample Schedule C Form Fill Online Printable Fillable Blank Pdffiller

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

Module 14B Simulation Using Form 1099MISC to Complete Schedule CEZ, Schedule SE, and Form 1040 In this simulation, you will take on the role of James King in order to learn how to claim selfemployment income 448 PM How do I transfer 1099G grant income to Schedule C?

Irs Form 1040 1040 Sr Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship 19 Templateroller

Schedule C Pdf Fill Online Printable Fillable Blank Pdffiller

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

1

Ppp Guide For Self Employed Schedule C 1099 Covid Chai 1

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Freelancers Meet The New Form 1099 Nec

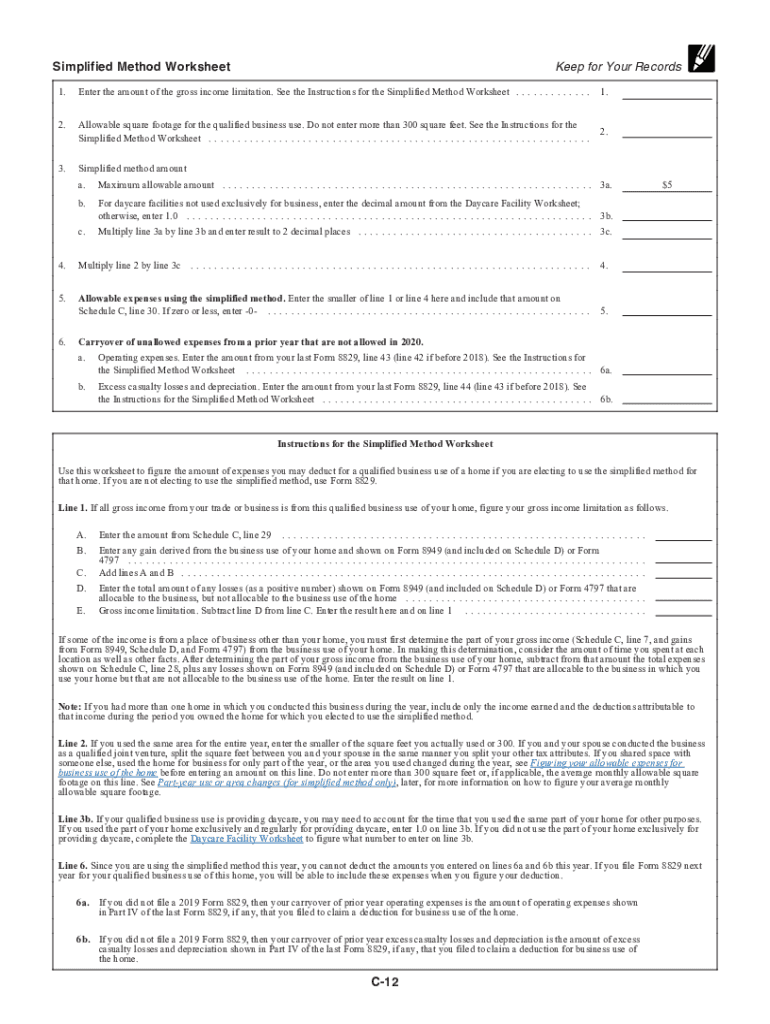

Simplified Method Schedulec Schedulef

Solved Re 1099 Misc Received As Reimbursement For Health

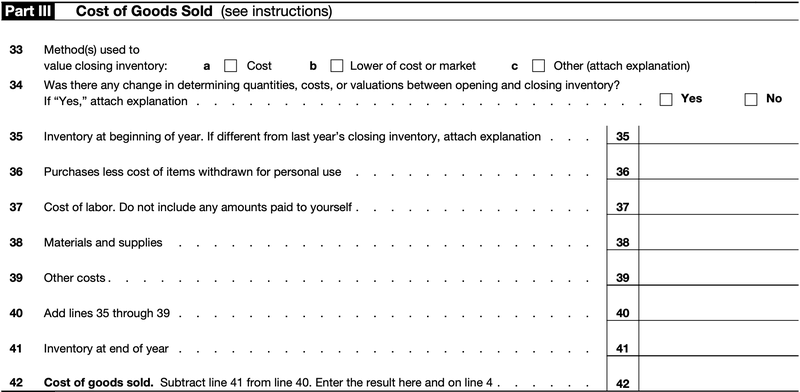

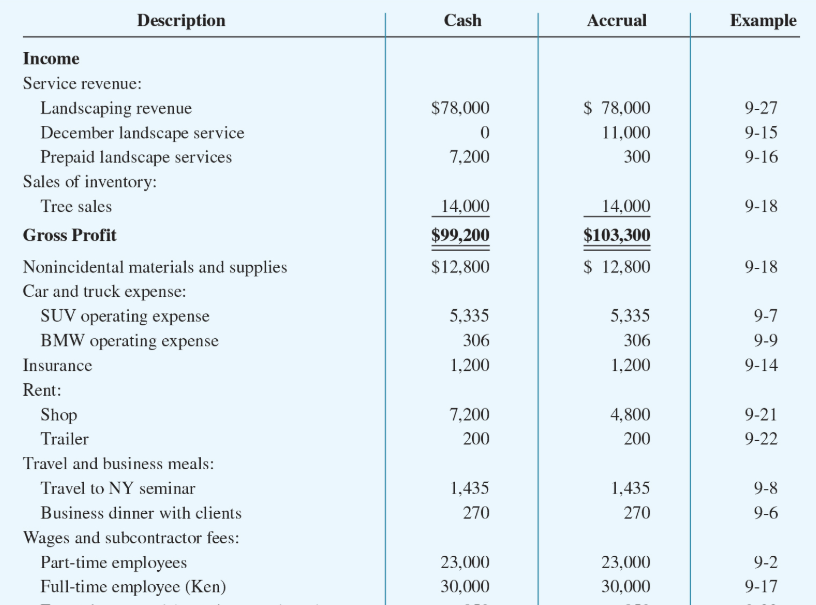

1 The Image Shows A Completed Schedule C Using The Cash Method Complete Schedule C Using Homeworklib

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

19 Schedule C Form 1040 Or 1040 Sr Willow Wade Pdf Schedule C Form 1040 Or 1040 Sr Profit Or Loss From Business Go Omb No 1545 0074 19 Sole Course Hero

2

2

Filing A Schedule C For An Llc H R Block

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

Sample 1040 Schedule C Filled Out Fill Out And Sign Printable Pdf Template Signnow

Blank Irs Federal Tax Form Schedule C For Reporting Profit Or Loss From Business Stock Photo Alamy

Profit Or Loss From Business Sole Proprietorship Irs Tax Form 1040 Schedule C 16 Package Of 100 U S Government Bookstore

How To Fill Out Schedule Se Irs Form 1040 Youtube

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

I Received A Form 1099 Misc What Should I Do Godaddy Blog

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Ppp Application Guide For Gig Workers Self Employed Sba Ppp Loan

Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

Irs Form 1040 Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship Templateroller

Edit This Is The Complete Instruction I Just Need Chegg Com

Ppp Second Draw Application Tutorial Self Employed Schedule C 1099 No Employees Homeunemployed Com

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

Sole Proprietor Tax Forms Everything You Ll Need In 21 The Blueprint

Step By Step Instructions To Fill Out Schedule C For

Irs Form 1040 1040 Sr Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship 19 Templateroller

2

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

1040 Schedule C Form Fill Out Irs Schedule C Tax Form

What Is An Irs Schedule C Form And What You Need To Know About It

What Is A 1099 Form H R Block

How To Complete 19 Schedule C Form 1040 Line A To J Youtube

2

1040 Erroneous Schedule C Schedulec

Publication 559 Survivors Executors And Administrators Internal Revenue Service

1099 Misc Form Fillable Printable Download Free Instructions

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart

Schedule C Form 1040 Free Fillable Form Pdf Sample Formswift

Form Instructions Your Complete Guide To Expense Your Home Office Zipbooks

1040 Schedule C Form Fill Out Irs Schedule C Tax Form

What Is Form 1099 Nec For Nonemployee Compensation

2

1

1099 Misc Form Fillable Printable Download Free Instructions

1040 Form Schedule C 19

How To Fill Out A Self Calculating Schedule C Profit Or Loss From Business Youtube

Given The Following Information Complete The 19 Chegg Com

Fillable Form 1040 Schedule C 19 In 21 Irs Tax Forms Credit Card Statement Tax Forms

1

How To Report Cryptocurrency On Taxes Tokentax

What To Do With The Irs 1099 C Form For Cancellation Of Debt Alleviate Financial Solutions

How To File Schedule C Form 1040 Bench Accounting

:max_bytes(150000):strip_icc()/ScheduleC-22b719c014fd419b89315bb420243dcf.jpg)

Irs Schedule C What Is It

How To Fill Out Schedule C For Business Taxes Youtube

Irs Instructions 1040 Schedule C 21 Fill Out Tax Template Online Us Legal Forms

Form 1099 Nec For Nonemployee Compensation H R Block

Schedule C An Instruction Guide Craftybase

Schedule C Self Employment Covered Ca Subsidies Home Office Hobby

Deducting Business Meals Other Expenses On Schedule C Don T Mess With Taxes

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

Schedule C Self Employment Covered Ca Subsidies Home Office Hobby

What Are The Required Documents For A Ppp Loan Faq Womply

1 The Image Shows A Completed Schedule C Using The Cash Method Complete Schedule C Using Homeworklib

14 Form Irs 1040 Schedule C Ez Fill Online Printable Fillable Blank Pdffiller

Irs Schedule C Instructions Schedule C Form Free Download

Tax Documents That Every Freelancer And Contractor Needs Form Pros

Deducting Business Meals Other Expenses On Schedule C Don T Mess With Taxes

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

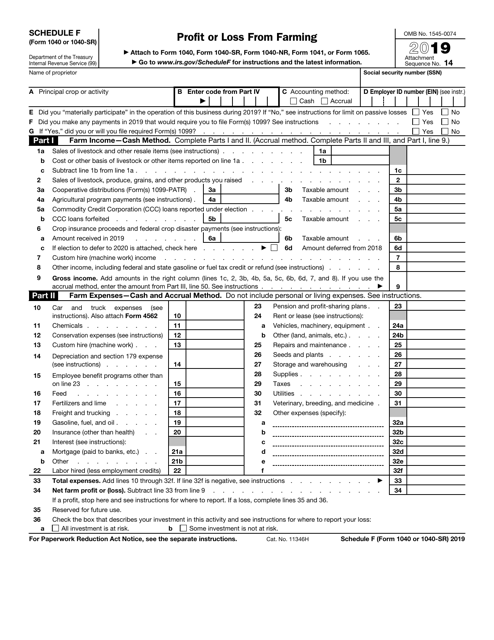

Schedule F Form Profit Or Loss From Farming Definition

Irs Form 1040 1040 Sr Schedule F Download Fillable Pdf Or Fill Online Profit Or Loss From Farming 19 Templateroller

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Profit Or Loss From Business Sole Proprietorship Irs Tax Form 1040 Schedule C 16 Package Of 100 U S Government Bookstore

2

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

Schedule C Form 1040 Sole Proprietor Independent Contractor Llc Ppp Loan Forgiveness Schedule C Youtube

What Do You Need To Fill Out Your 1040